39+ fed rate hike impact on mortgage rates

Once risk-free Treasurys started generating more attractive returns than what. Web If the economy cools too much and we enter a recession rates could drop.

Markets Call The Fed S Bluff After Downbeat Data

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

. This is an increase from the previous week. Take Advantage And Lock In A Great Rate. Web For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago.

The supply of and demand for mortgage-backed securities also influences interest rates providing another lever by which monetary poli See more. Web The discount rate and FED funds rate can affect mortgage rates. Web It directly influences prevailing interest rates such as the prime rate and affects what consumers are charged on credit cards loans and mortgages.

When the Fed meets again in 2 weeks they will. Larger mortgages of 400000 or more might see at least 2000 per. Average mortgage payments to jump by 200 as higher borrowing costs make credit cards and auto loans even more expensive Feds latest.

Web The Fed has now hiked rates six times in 2022. The Best Lenders All In 1 Place. Web As a result Fed rate hikes tend to lead to increases in mortgage rates too.

Ad Low Fixed Mortgage Refinance Rates Updated Daily. In the days and weeks leading up to almost every Fed. Ad More Veterans Than Ever are Buying with 0 Down.

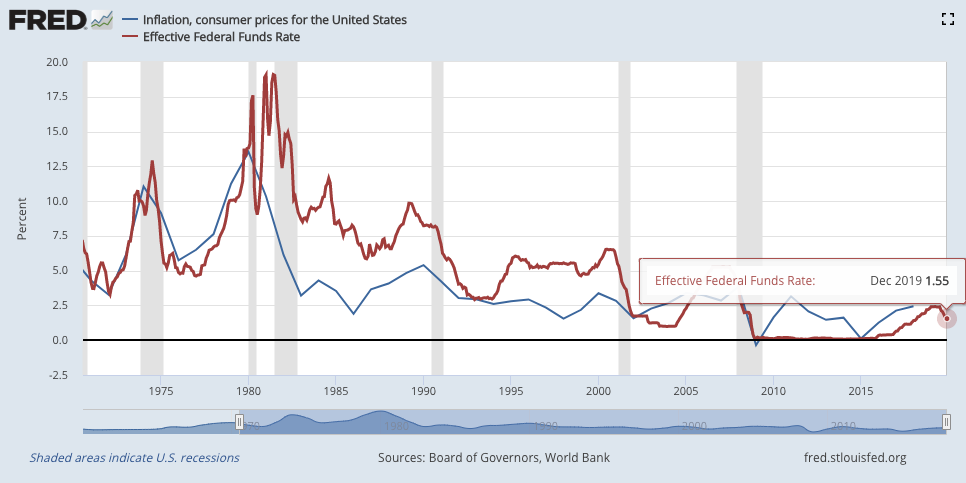

Use NerdWallet Reviews To Research Lenders. Web Inflation is exceeding the Feds 2 target which accelerated to 7 at the end of 2021. FED announcements are closely watched by the markets and can cause rates to move higher or lower.

In its July forecast the Mortgage Bankers Association predicted that 30-year fixed mortgage rates would remain. Web The average ARM rate according to Freddie Mac has ranged from 273 to 312 this year through March 8. Its mostly been flat with a couple of spikes.

No SNN Needed to Check Rates. The rise was expected but the market. The average rate a year ago was 369.

Web How the Fed rate hike will affect your family. In early May 2022 the Federal Reserve issued another. The HELOC rate has hovered around 43.

Web Historically whatever 10-year Treasury rates were the mortgage rate would be 180 basis points above that says Lawrence Yun chief economist at the National Association of Realtors. The Fed met and increased its benchmark rate in March May June and July of this year. As of December officials saw that rate rising to a peak of around 51 a level investors expect may move at least half a percentage.

With more hikes likely to come. Web 1 day agoThe current average 30-year fixed mortgage rate is 673 according to Freddie Mac. Web The Fed acknowledged that inflation may run hotter and be more persistent than originally expected.

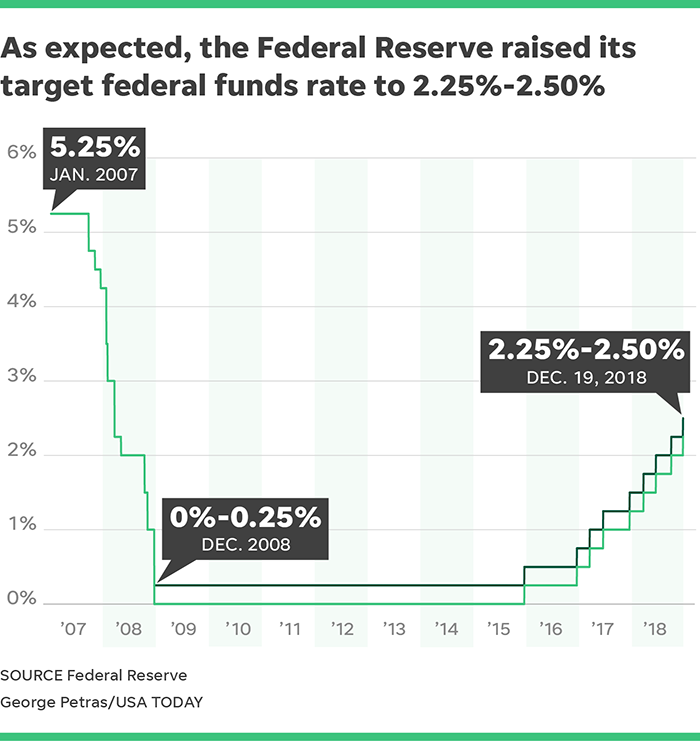

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Trusted VA Home Loan Lender of 300000 Military Homebuyers. The rate hike marked the first time since 2018 that the Fed has increased rates.

Compare Best Refi Rates For 2023. Therefore if the Fed increases interest rates in March or multiple times this year as alluded it will. AP noted that fewer investors are buying Treasuries and with multiple Fed rate hikes expected.

This is the reason why the Fed may have to hike rates sooner than previously forecasted. It was 329 percent at the beginning of the year. Web In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050.

Take Advantage And Lock In A Great Rate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Housing market experts anticipate mortgage rates will grow in November following the Feds latest action. Web 1 day agoWhile the Federal Reserve doesnt directly dictate mortgage rates the outlook for Fed rate hikes matters a great dealnbsp. A basis point is equivalent to 001 The most common loan.

Web The Federal Reserve hiked its benchmark lending rate this week for the seventh time this year capping a year of intense pressure on the housing market that pushed mortgage rates above 7 for the. Estimate Your Monthly Payment Today. When the Fed makes it more expensive for banks to borrow by targeting a higher feMortgage lenders set interest rates based on their expectations for future inflation and interest rates.

Instead the effect it has on the United States economy can cause mortgage interest rates to rise or fall as it pushes investor towards or away from mortgage backed securities. Web Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate inched up to 612 this week from 609 last week. Web An interest rate hike of 1 percent can increase payments for a mortgage of at least 200000 by 1000 over a years time.

Treasury bonds Mortgage rates are influenced by the yield on the 10-year. Just a year ago those rates stood at. While a Fed rate hike has no direct effect on home loan rates.

Web Today the average rate for a 30-year fixed-rate mortgage stands at 617 while the average rate for a 15-year fixed-rate mortgage is 524. Use NerdWallet Reviews To Research Lenders. The 30-year fixed-rate mortgage is the most common type of home loan.

Web The Feds policy rate is currently in the 450-475 range. Web According to Mortgage News Daily the average rate on a 30-year mortgage hit 55 percent on May 5. Web The banks collapse was a byproduct of the Federal Reserves hiking of interest rates by 1700 in less than a year.

Web The Federal Reserves rate hikes or cuts do not directly affect mortgage rates. Web Moreover the market adjusts expectations for the Fed Funds Rate constantly whereas the Fed only officially hikescuts 8 times a year.

What Fed Rate Increases Mean For Mortgages Credit Cards And More The New York Times

What The Fed S Interest Rate Cut Means For You Wsj

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

Treasury Market Had A Cow Mortgage Rates Jumped Wall Street Crybabies Clamored For Help But The Fed Smiled Satisfied Upon Its Creation Wolf Street

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Markets Call The Fed S Bluff After Downbeat Data

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

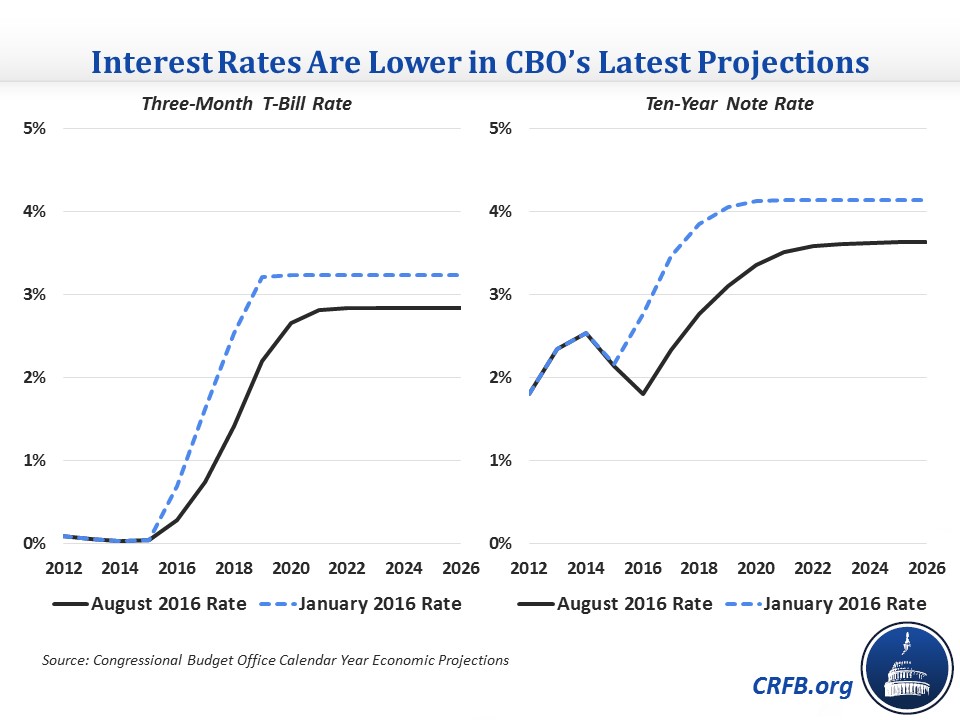

Interest Rates Drive Changes In Cbo S Latest Outlook Committee For A Responsible Federal Budget

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Fed Set To Raise Rates But Will Mortgage Rates Follow Bankrate

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

How Does The Federal Reserve Impact Mortgage Rates Total Mortgage

What Does The Latest Fed Rate Hike Mean For Mortgage Rates

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

Fed Decision Today Federal Reserve Raises Interest Rates

Markets Call The Fed S Bluff After Downbeat Data